White families’ median income is 1.7x higher than the median income of families of color.1

18.5% of Nebraskans experience asset poverty and are likely one emergency away from financial crisis.2

2. Assets and Opportunity Nebraska State Data, 2016.

Our values

Our children, communities, and state are stronger when all of Nebraska’s families are able to participate fully in the workforce and establish financial security.

Achieving economic stability occurs when parents have the education, skills, and opportunity to access work that pays a living wage. In turn, parents who are economically stable can provide their children housing, child care, health care, food, and transportation.

Public assistance provides a vital safety net for families who are unable to provide these necessities on their own. Well-structured public assistance programs gradually reduce assistance while supporting families moving toward financial independence.

Poverty

42.8%

of children living in single-mother households are in poverty.1

26.5%

of children living in single-father households are in poverty.1

7.7%

of children living in married-couple households are in poverty.1

11.4%

Grandparent responsible for grandchildren in poverty.2

2. U.S. Census 2015 American Community Survey 1-year estimates, Table B10059.

In the United States, there is an ongoing relationship between race and ethnicity and poverty, with people of color experiencing higher rates of poverty. Poverty rates in Nebraska also continue to reveal significant disparities based on race and ethnicity. These disparities grew out of a history of systemic barriers to opportunity for people of color that still have a presence in our society and institutions today. We need to continue working to address these barriers in order to ensure that all children have the best opportunity to succeed.

Nebraska poverty (2006-2015)

- Percent of Children in Poverty

- Percent of Families in Poverty

- Percent of All Persons in Poverty

- Percent of Children in Poverty

- Percent of Families in Poverty

- Percent of All Persons in Poverty

| Nebraska poverty rates (2015) | |

| Poverty rate for children | 16.8% |

| Poverty rate for families | 14.4% |

| Poverty rate for all persons | 12.6% |

| Nebraska poverty by race/ethnicity (2014) | ||

| Race/ethnicity | Percent of children in poverty (17 and under) | Percent of population in poverty |

| White, non-Hispanic | 11.1% | 9.7% |

| Black/African American | 46.0% | 33.0% |

| American Indian or Alaska Native | 53.1% | 43.2% |

| Asian or Pacific Islander | 18.0% | 16.8% |

| Some other race | 29.2% | 23.4% |

| Two+ races | 24.7% | 22.0% |

| Hispanic or Latino | 33.0% | 26.2% |

Making Ends Meet

Making ends meet

Nebraskans pride themselves on being hard-working people. In 2015, 77.9% of children in our state had all available parents in the workforce.1 Unfortunately, having high labor-force participation doesn’t always translate into family economic stability.

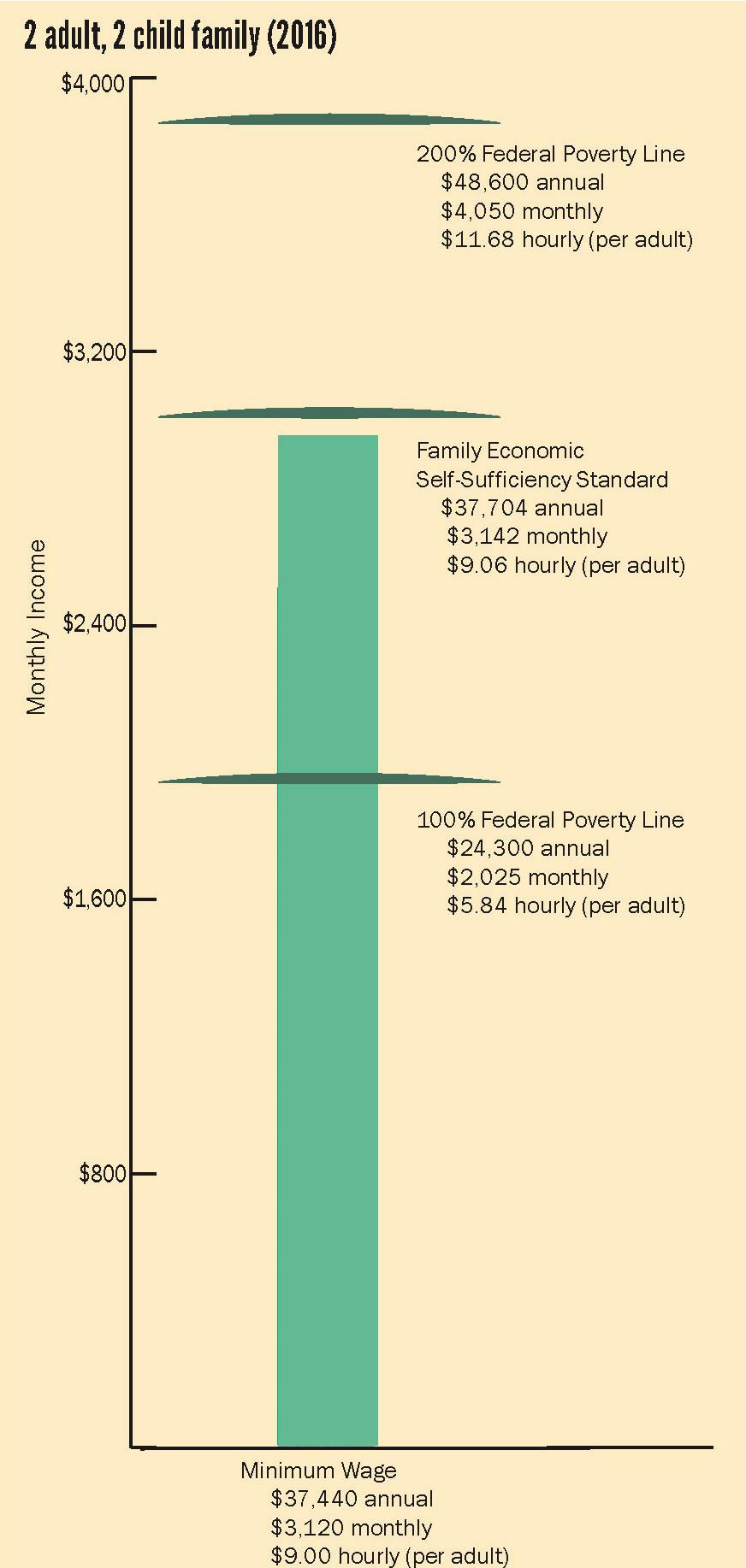

The chart at right illustrates the gap between low-wage earnings and the amount needed to provide for a two-parent family with two children. It assumes that both parents work full-time (40 hours a week), year round (52 weeks per year). That means no vacation, no sick time, just work.

Minimum wage in Nebraska is $9.00 an hour.2* If both parents work at minimum wage, their monthly income will be $3,142. This puts them above the federal poverty level of $2,025.

The federal poverty level doesn’t describe what it takes for working families to make ends meet. For that we turn to the Family Economic Self-Sufficiency Standard (FESS). The FESS uses average costs, like fair median rent or the average price of a basic menu of food, to calculate what a family needs to earn to meet its basic needs without any form of private or public assistance. It does not include luxuries like dining out or saving for the future.

For a two-parent, two-child family of any age, the FESS for Nebraska is $3,142 a month.3 That requires an hourly wage of $9.06 per parent.

2. United States Department of Labor, “Minimum Wage Laws in the States – January 1, 2015,” www.dol.gov.

3. FESS was calculated using an average of 2010 figures for a two-adult, two-child family, adjusted for 2015 inflation. Data used to calculate information is courtesy of Nebraska Appleseed Center for Law in the Public Interest. For more information, please see the Family Bottom Line Report: www.voicesforchildren.com/familybottomline.

2015 Federal Poverty Level Guidelines

|

Program Eligibility

|

|

Child Care Subsidy

|

SNAP

|

|

WIC Reduced Price Meals

|

CHIP (Kids Connection)

|

|

ACA Exchange Tax Credits

|

|

Family size

|

100%

|

130%

|

133%

|

150%

|

185%

|

200%

|

300%

|

400%

|

| 1 | $11,770 | $15,301 | $15,654 | $17,655 | $21,775 | $23,540 | $35,310 | $47,080 |

| 2 | $15,930 | $20,709 | $21,187 | $23,895 | $29,471 | $31,860 | $47,790 | $63,720 |

| 3 | $20,090 | $26,117 | $26,720 | $30,135 | $37,167 | $40,180 | $60,270 | $80,360 |

| 4 | $24,250 | $31,525 | $32,253 | $36,375 | $44,863 | $48,500 | $72,750 | $97,000 |

| 5 | $28,410 | $36,933 | $37,785 | $42,615 | $52,559 | $56,820 | $85,230 | $113,640 |

| 6 | $32,570 | $42,341 | $43,318 | $48,855 | $60,255 | $65,140 | $97,710 | $130,280 |

| 7 | $36,730 | $47,749 | $48,851 | $55,095 | $67,951 | $73,460 | $110,190 | $146,920 |

| 8 | $40,890 | $53,157 | $54,384 | $61,335 | $75,647 | $81,780 | $122,670 | $163,560 |

*For families with more than 8 people, add $4,160 for each additional member.

Aid to Dependent Children

Aid to Dependent Children (ADC) (2015)

ADC recipients by age (SFY 2015)

- Ages 19+ (21.6%)

- Ages 15-18 (10.6%)

- Ages 6-14 (34.3%)

- Ages 0-5 (33.5%)

- Ages 19+ (21.6%)

- Ages 15-18 (10.6%)

- Ages 6-14 (34.3%)

- Ages 0-5 (33.5%)

12,529

Average monthly number of children receiving ADC

6,063

Average monthly number of families receiving ADC

$330.39

Average monthly ADC payment per family

$24,037,883

Total ADC payments (SFY 2015) (Includes both state and federal funds)

- Federal TANF Funds

- State General Funds

Is Nebraska’s safety net catching families in need?

Aid to Dependent Children (ADC), Nebraska’s cash assistance program, is intended to support very low-income families with children struggling to pay for basic needs. According to the Nebraska Department of Health and Human Services, ADC payments are often the only form of income for participating families.1

The chart below explores whether ADC adequately reaches children and families in need. The number of children in poverty and extreme poverty over time is compared with the number of children receiving ADC. The gaps between extreme poverty and ADC enrollment suggest that Nebraska’s safety net has not kept pace with growing needs.

Children receiving ADC vs. children in poverty and extreme poverty (2006-2015)

- Poverty (50 - 100% FPL)2

- Extreme Poverty(under 50% FPL)2

- ADC enrollment1

- Poverty (50 - 100% FPL)2

- Extreme Poverty(under 50% FPL)2

- ADC enrollment1

ADC increase with LB 607

The Aid to Dependent Children program received additional funding with the adoption of LB 607 in 2015. LB 607 sought to address a problem with the ADC program, in which the payments did not adequately cover the cost of living: in 2013, the average monthly payment was only $326.17. The enacted bill raises the monthly payment level to 55% of the standard of need, an average increase of $72 per month to help approximately 6,200 Nebraska families with low incomes. It also provides financial assistance to families transitioning off of ADC to help them get back on their feet.

2. U.S. Census Bureau, American Community Survey 1-year estimates, Table B17024.

Housing & Homelessness

Homelessness

The Nebraska Homeless Assistance Program (NHAP) serves individuals who are homeless or near homeless. Not all homeless people receive services.

In 2015, HUD/NHAP served:

6,309

homeless individuals.

1,596

individuals at risk of homelessness.

2,201

homeless children ages 18

and under.

746

children ages 18 and under at risk of homelessness.

In 2015, Nebraska Public Housing had:2

- 7,367 public housing units with 7,061 occupied.

- 12,792 vouchers with 11,609 in use.

- 4,785 units were 1 bedroom (non-family).

- 42,000 children lived in crowded housing.3

- 42,000 children lived in areas of concentrated poverty.3

- 109,000 children lived in households with a high housing cost burden.3,4

- 91,000 children were low-income with a high housing cost burden.3

Homeownership

Homeownership provides a sense of stability for children and communities.

68.2% of families with children owned their home in 2015.1

Homeownership by race/ethnicity (2015)5

2. Nebraska Office of Public Housing, HUD.

3. Annie E. Casey Foundation, Kids Count Data Center.

4. Ibid. Families with high housing cost burdens spend more than 30% of their pre-tax income on housing.

5. U.S. Census Bureau, 2015 American Community Survey 1-year estimates, Table B25003B-I.

Hunger

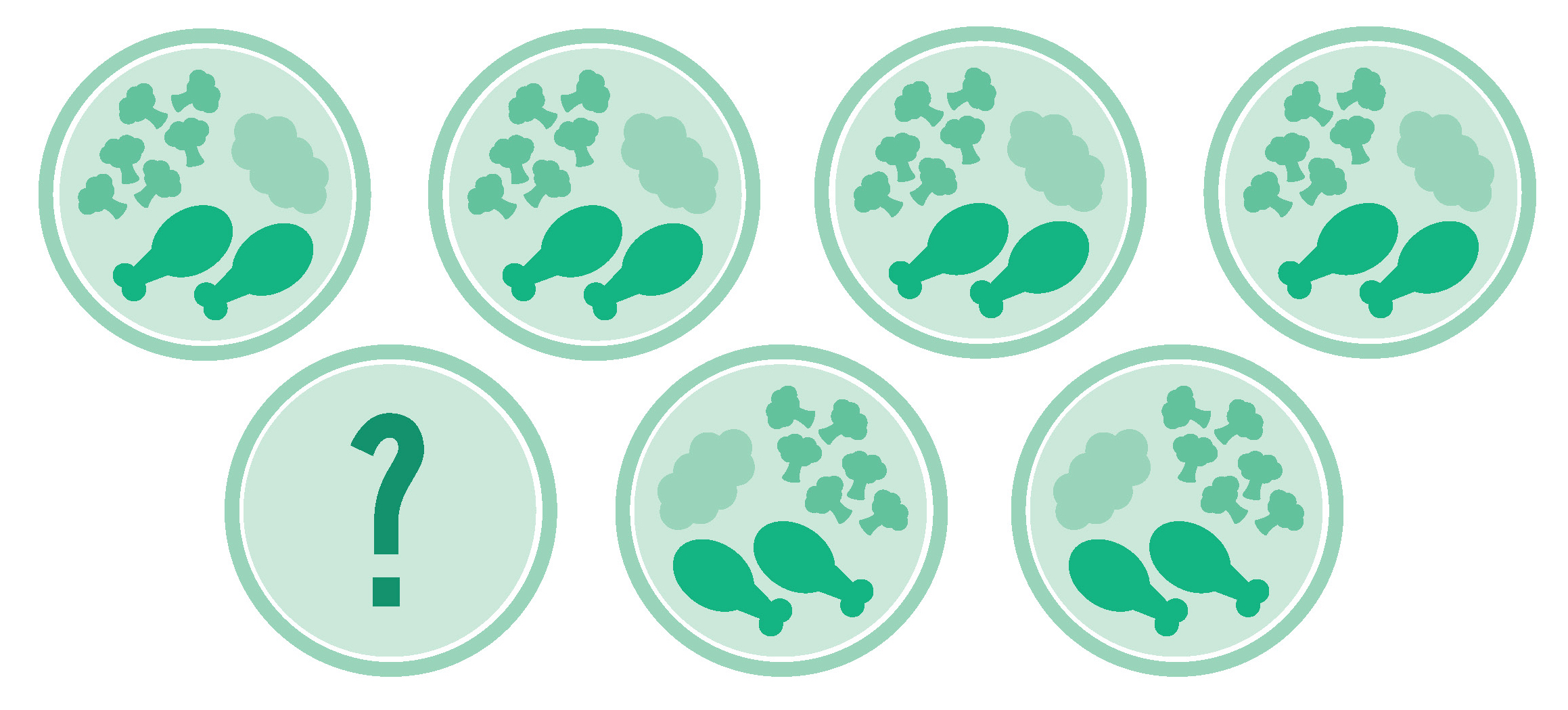

1 in 7 Nebraska households don’t know where their next meal is coming from.1

Food insecure households in Nebraska (2006-2015)1

With poverty rates remaining high in recent years, it is not surprising that many families with children struggle to put food on the table. Approximately 111,888 households in Nebraska were food insecure in 2015—meaning they didn’t know where their next meal was coming from at some point during the last year.

61% of food insecure children are likely eligible for federal nutrition assistance (2014).2

2. Feeding American, Map the Meal Gap 2016.

SNAP & WIC

Supplemental Nutrition Assistance Program

The Supplemental Nutrition Assistance Program (SNAP) is one of the most effective anti-poverty programs in the United States. It provides nutrition assistance to low-income individuals and families through benefits that can be used to purchase food at grocery stores, farmers markets, and other places where groceries are sold.

In Nebraska in 2014, SNAP moved 8,300 households above the poverty line.

Average number of children enrolled in SNAP (June 2006-2015)

SNAP participants by race (June 2015)

Total Child Population

- White (84.1%)

- Black (7.0%)

- American Indian (1.3%)

- Asian (2.9%)

- More than one race (4.7%)

- White (84.1%)

- Black (7.0%)

- American Indian (1.3%)

- Asian (2.9%)

- More than one race (4.7%)

Child SNAP Participants

- White (51.3%)

- Black (18.2%)

- American Indian (3.9%)

- Asian (2.9%)

- More than one race (5.2%)

- Other (12.2%)

- Unknown (6.2%)

- White (51.3%)

- Black (18.2%)

- American Indian (3.9%)

- Asian (2.9%)

- More than one race (5.2%)

- Other (12.2%)

- Unknown (6.2%)

48.9%

of new babies were enrolled in WIC in 2015

Women, Infants, and Children (WIC) (2015)

Of the monthly average 36,960 WIC participants in 2015:

- 9,508 were women;

- 8,361 were infants; and

- 17,828 were children

97 clinics in 91 counties report

participating in WIC.

| Average Monthly Cost Per Participant (2015) | |

| Clinic Services | $17.72 |

| Food Costs | $46.68 |

U.S. Census Bureau, Population Estimates Program, 2015 Annual Estimates of the Population, Table PEPASR6H.

Custody

Marriage and divorce

In 2015…

12,119 couples were married and

6,018 were divorced.

5,618 children

experienced their parents divorcing.

2,985 children

were put under their mother’s custody.

507 children

were put under their father’s custody.

2,046 children

were put under both parent’s custody.

77 children

were given a different arrangement.

Informal kinship care:

children living with grandparents, extended family, or close friends without the involvement of the child welfare system.

11,000 (2%)

children were living in kinship care in 2014-16.

11,000 (2%)

were living with a grandparent who was their primary caregiver in 2015.

Child support (2015)

Custodial parents who do not receive child support payments they are owed by non-custodial parents may seek assistance from the Department of Health and Human Services. Assistance is provided by Child Support Enforcement (CSE).

- 180,443 cases received CSE assistance, this is 71.4% of child support cases in Nebraska.

- 101,793 were non-ADC cases.**

- 6,650 were ADC cases.**

- $218,163,424 of child support collected through CSE.

- $217,341,153 of child support disbursed through CSE.

- 19,002 cases received services through CSE, but payments were not being made.

- 1,672 cases received public benefits who are eligible for child support, but it was not being paid.

- 4,904 child support cases where non-custodial parent is incarcerated

** If the custodial parent is receiving ADC, the state is entitled to collect child support from the non-custodial parent as reimbursement.

Employment & Income

In 2015,

75.6%

of all children had all available parents in the workforce

71.6%

of children under 6 had all available parents in the workforce

Nebraska unemployment and underemployment rate (2006-2015)

- Unemployment

- Underemployment

- Unemployment

- Underemployment

| Median income for families with children (2015) | |

| All Families | $71,039 |

| Married couple | $86,761 |

| Female householder (no husband) | $26,314 |

| Male householder (no wife) | $39,290 |

13,000 workers in Nebraska earned minimum wage or below in 2015.1

28.9% of Nebraska workers were working in a low-wage job, meaning the median annual pay is below the poverty line for a family of four.2

2. Assets and Opportunity Nebraska State Data, 2016.

| Median income for families by race/ethnicity (2015) | |

| Black/African American | $44,825 |

| American Indian | $38,346 |

| Asian | $62,390 |

| Other | $41,474 |

| 2+ races | $46,194 |

| White, non-Hispanic | $76,224 |

| Hispanic | $39,883 |

18.5%

of Nebraskans experience asset poverty with

10.2%

in extreme asset poverty.2

These households do not have sufficient net worth to subsist at the poverty level for 3 months and 1 month, respectively, in the absence of income.

Transportation & Taxes

Family tax credits (2015)

133,688 families claimed $314,901,957 in federal Earned Income Tax Credit (EITC).

132,598 families claimed $30,955,482 in state Earned Income Tax Credit.

152,553 families claimed $207,159,661 in federal Child Tax Credit.

53,950 families claimed $28,354,908 in federal Child and Dependent Care Credit.

57,294 families claimed $11,909,837 in state Child and Dependent Care Credit.

96,180 families claimed $134,806,425 in Additional Child Tax Credit.

5.4% of households had no vehicle available in 2015.

Nebraska state and local taxes, shares of family income by income group (2014)

- % Income to state and local taxes

- % Income to state and local taxes